Asian Americans lag behind in homeownership and face discrimination in the mortgage market. This reality busts the Model Minority stereotype that Asian Americans are doing well. The homeownership rate for Asian Americans is around 60%, a rate lower than the national average of 65% and much lower than 72% for White Americans.

There has never been a time where more home buyers are White, older and wealthier, according to data from the 2022 Profile of Home Buyers and Sellers from The National Association of Realtors (NAR). White Americans accounted for 88% of home sales. Asian Americans accounted for 2% of home sales despite accounting for more than 6% of the U.S. population.

This reality shows the myth of the Model Minority stereotype of Asian Americans with high incomes and wealth. Asian Americans lag behind in homeownership and face discrimination that hinders our ability to become homeowners and build generational wealth. Even though Asian American homeownership has been rising, the homeownership rate for Asian Americans is around 60%. This rate is higher than other communities of color, but it is lower than the national average of 65% and much lower than 72% for White Americans. For reference, the Asian homeownership rate was 53% in 2000 per U.S. Census data.

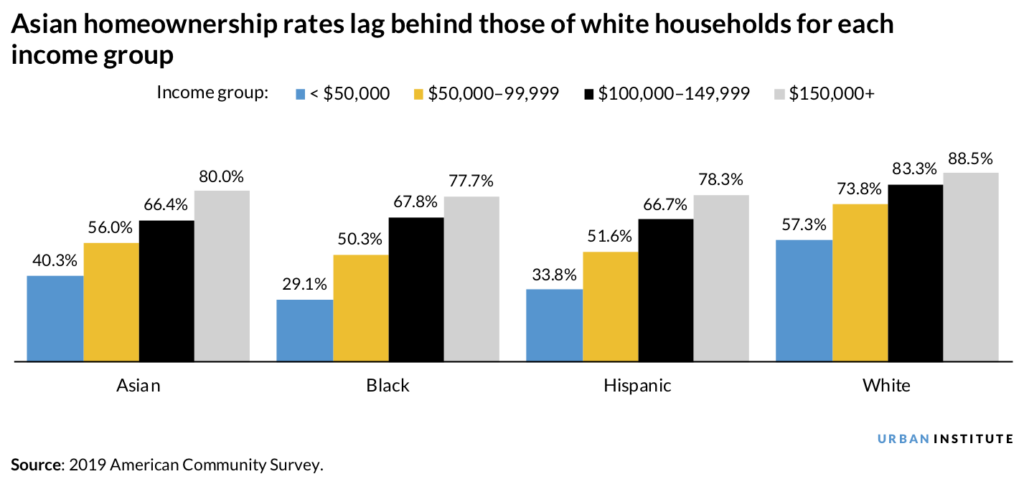

When Asian American homeownership is disaggregated by income, Asian American homeownership is closer to Black and Hispanic Americans across all income levels.

Asian American homeownership is surprisingly closer to Black and Hispanic Americans across all income levels when it is disaggregated by income per findings from the Urban Institute, a 50+ year-old nonprofit research organization that provides data and evidence to help advance upward mobility and equity.

Asian homeownership is lowest in the Midwest and Northeast

Regionally, the Asian American homeownership gap is widest in the Midwest (a 10% gap) and Northeast (a 7% gap ) per the 2020-2021 State of Asia America report by Asian Real Estate Association of America.

Home ownership rate by region:

| US Region | Asian Americans | Regional Average | Gap |

|---|---|---|---|

| Midwest | 58% | 68% | -10% |

| Northeast | 55% | 62% | -7% |

| South | 65% | 65% | na |

| West | 61% | 60% | +1% |

Asian immigrants are more likely to own a home than U.S.-born Asians

Asian immigrants are more likely to own a home than U.S.-born Asians (60% vs. 56%). In 2019, there were more than 14 million immigrants with origins from Asian countries in the United States. China, India, Korea and the Philippines make-up nearly 60% of the Asian immigrant population. Immigrants from these origin countries tend to earn higher incomes, work in management occupations and are highly educated. (U.S. Immigration policy since 1965 gave preference to highly-educated and highly-skilled applicants, a contrast to the majority of pre-1965 immigrants from Asia who tend to be low-skilled.) As such, the income distribution among Asian households is highly unequal.

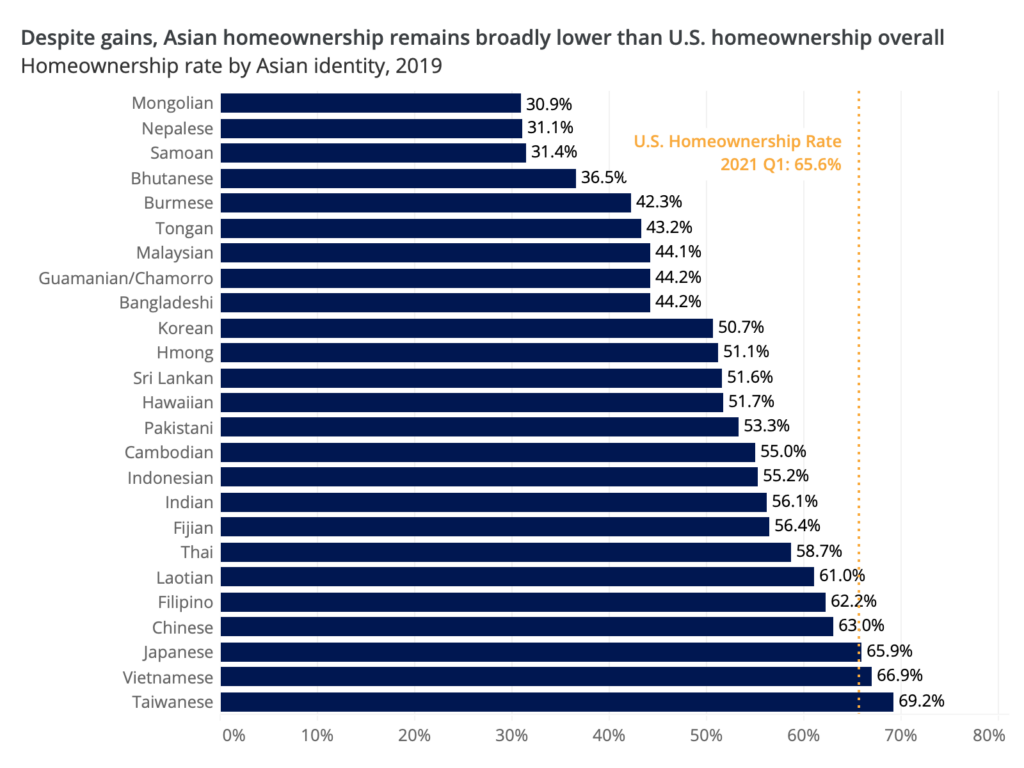

Most Asian sub-racial groups have home ownership rates below the national average

Homeownership rates range widely by ethnicity, from over 69% for Taiwanese Americans to 31% for Mongolian and Nepalese Americans in 2019 per Zillow, an online real-estate marketplace that has data of around 110 million homes across the U.S.

Mortgage challenge of higher denial rates

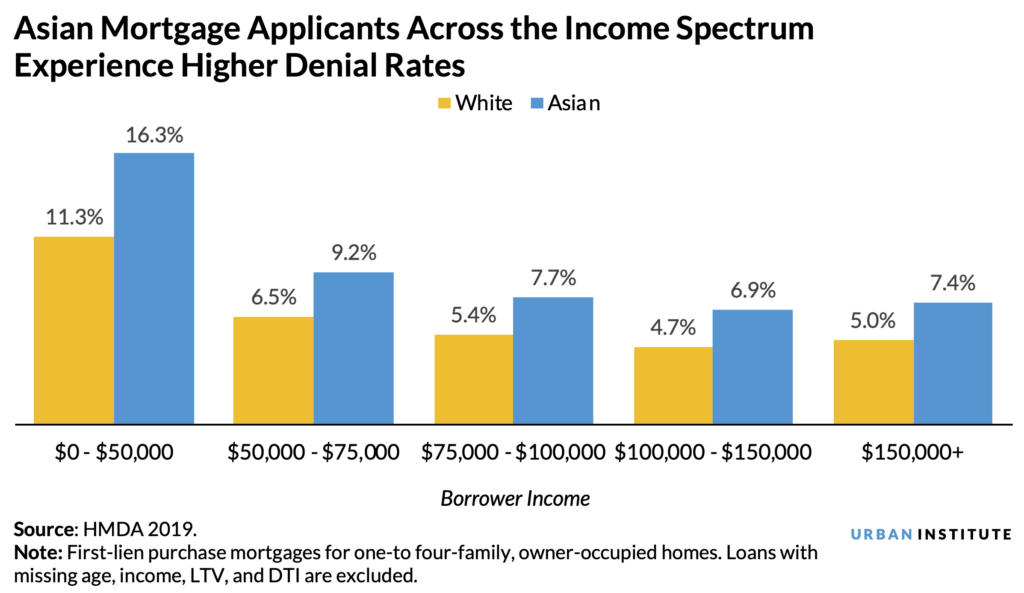

Nearly 8 out of every 10 home buyers finance their home purchase. Asian applicants are disproportionately denied mortgages even with higher credit scores and higher income compared to White applicants. The denial rate for Asian American mortgage applicants is 8.7% compared to 6.7% of White mortgage applicants.

Across all income levels, the denial rates are higher for Asian American mortgage applicants per the Urban Institute when it analyzed 2019 Home Mortgage Disclosure Act (HMDA) data. The U.S. enacted HMDA in 2011 requiring financial institutions to maintain, report and make public mortgage data.

Credit and language barriers

On average, Asian American borrowers tend to be younger, have higher income, and higher credit scores than the overall U.S. population. Despite higher income, Asian households have limited credit histories.

Language barriers and limited English proficiency are also barriers to home ownership. 28% of Asian Americans are less than proficient in English. Another challenge is the prevalence of multi-generational living (around 27%) among Asian American households, which requires them to spend more money on housing. Asian American borrowers also typically live in comparatively expensive metro areas, resulting in higher average loan amounts than their peers per the Consumer Financial Protection Bureau.

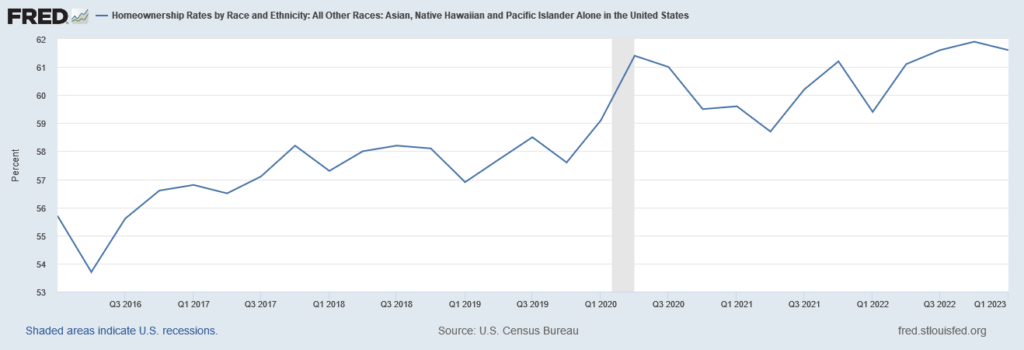

Despite challenges, Asian home ownership is trending up

As of the Q1 2023, the home ownership rate for Asian, Native Hawaiian and Pacific Islander Alone in the U.S. increased to 61.6% from 55.7% 7 years ago (Q1 2016) according to the latest data by the Federal Reserve Bank of St. Louis.

Asian American female homeownership is also on the rise

Over the past 30 years, more women are becoming homeowners. Women’s gains in education and higher incomes lead to higher rates of home-ownership and more women heads of households. The home ownership rate among women increased from 51% to 61% between 1990 and 2019, while the home ownership rate among men dropped from 71% to 67%.

Asian women experienced the greatest increase in homeownership. Asian women accounted for the biggest change from 1990 – 2019, an increase of over 18% in homeownership rate, followed by Hispanic women at 15%, White women at 13%, and Black women at 6%. This increase has narrowed the homeownership rate gap to less than 2% between Asian women and Asian men. The homeownership rate is 61% for Asian men and 59% for Asian women.

As long as a home is a symbol of stability and wealth, Asian Americans like all Americans will look to own a home.

Helpful Resources

Asian and Pacific Islander-Headed Households Face Highest Housing Payment Burdens Among All Races (Zillow Research, 2023)

Asian Real Estate Association of America

Get a monthly dose of our latest insights!

About

myasianvoice

At MyAsianVoice, we connect Asian Americans to surveys and research to bridge the Asian data gap.

Join our growing respondent list >>