Family, Government, Money

AG report finds Asian, Black, and Latino New Yorkers are less likely to own a home and face higher barriers to financing

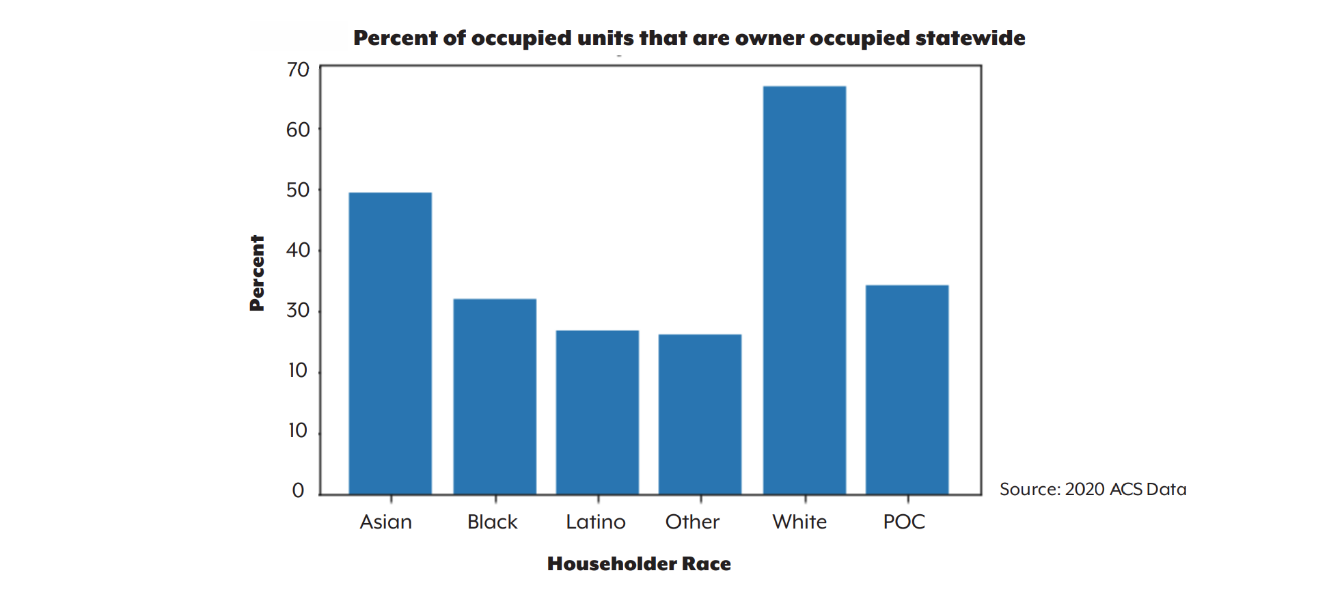

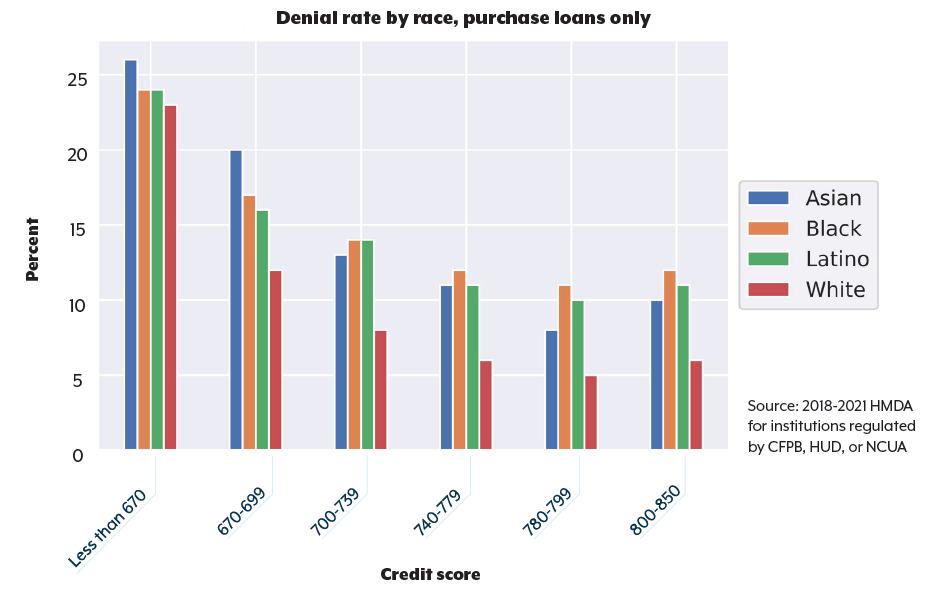

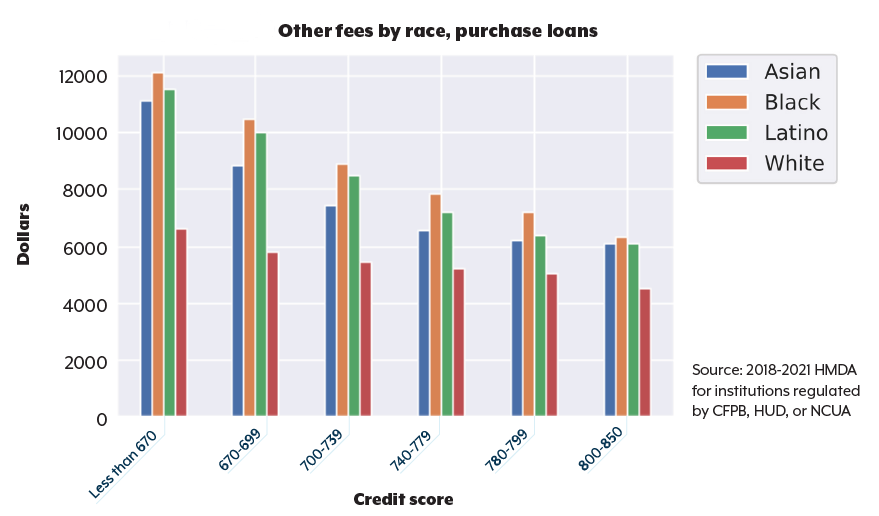

New York State’s Office of the Attorney General released on October 31, 2023, a new report detailing deep racial disparities in homeownership and access to home financing. The report finds homeownership in New York is concentrated in White households and neighborhoods. White households are 25% more likely than Asian households and over 50% more likely than Black or Latino households to own their home. Asian, Black, and Latino borrowers also face significant barriers when looking to purchase or refinance a home. They are denied mortgages at higher rates than White applicants, regardless of credit score, income, size of the loan, and other factors. Asian applicants have the highest denial rates at credit scores under 700. And Asian, Black, and Latino borrowers pay higher costs and fees across all credit score ranges.

New York State’s Office of the Attorney General released a new report detailing deep racial disparities in homeownership and access to home financing. The report finds homeownership in New York is concentrated in White households and neighborhoods. White households are 25% more likely than Asian households and over 50% more likely than Black or Latino households to own their home. Asian, Black, and Latino borrowers also face significant barriers when looking to purchase or refinance a home. They are denied mortgages at higher rates than White applicants, regardless of credit score, income, size of the loan, and other factors. And Asian, Black, and Latino borrowers pay higher costs and fees across all credit score ranges.

New York State homeownership

White households are 25% more likely than Asian households and over 50% more likely than Black or Latino households to own their home.

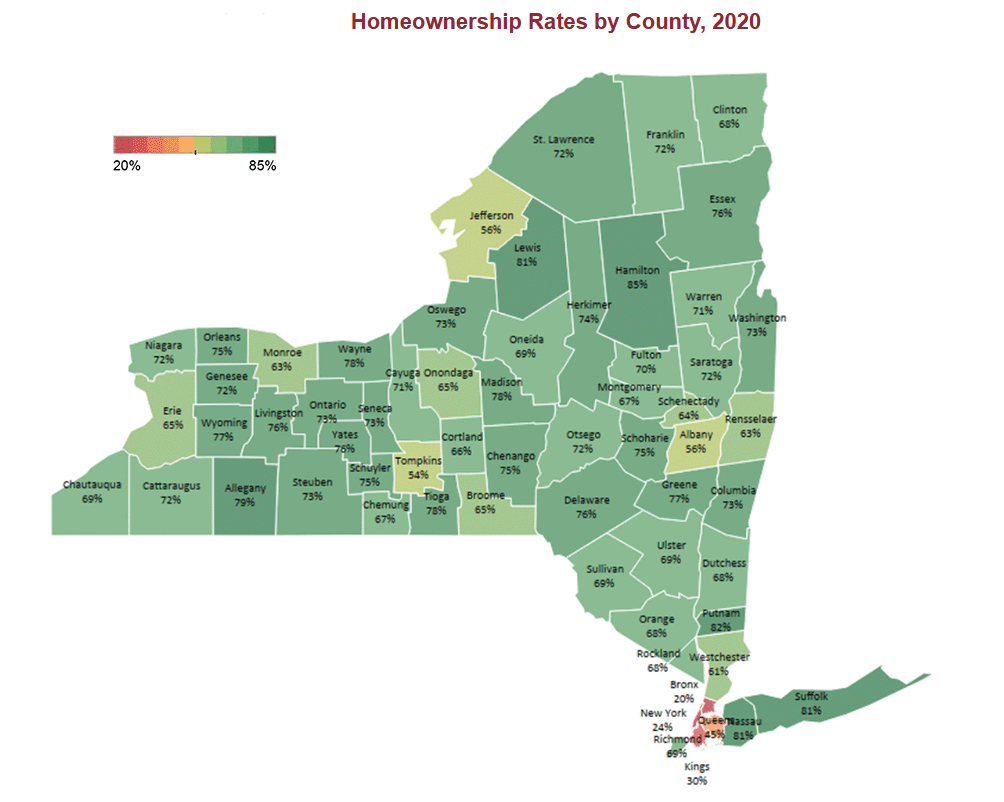

According to the State Comptroller’s office, New York has the lowest homeownership rate among the states, with only 54% of New Yorkers owning a home in the second quarter of 2022, compared to 65% nationally. In New York City, homeownership rates are as low as 20% in the Bronx and 24% in Manhattan, while some counties outside of New York City have homeownership rates exceeding that of the state and nationally.

Higher mortgage denial rates across credit scores

Asian, Black, and Latino New Yorkers are denied home-purchase loans more frequently than their White counterparts. These disparities remain even across credit scores. Asian New Yorkers have the highest denial rates, higher than Black and Hispanic applicants, at credit scores under 700.

Higher costs and fees across credit scores

Mortgage loans have costs and fees associated with loan processing and origination, and points to be paid for lower interest rates for purchase and refinancing loans. The report finds Asian, Black, and Latino borrowers pay higher costs and fees than White borrowers across all credit score ranges.

Bigger than enforcement: New York policy mandate

“Owning a home is an essential part of achieving the American dream and building wealth to pass on to future generations,” said Attorney General James. “Unfortunately, unequal access to affordable credit is still pervasive across our state, reinforcing the legacy of segregation, leading to a disparity in homeownership, and fueling the racial wealth gap. This report makes it clear that our state must do more to provide better resources for homebuyers and strengthen housing laws to help empower more New Yorkers. My office remains committed to fighting housing discrimination in all forms, and I look forward to working with my partners in government to address this problem.”

Helpful Resources

Racial Disparities in Homeownership (Office of the New York State Attorney General, 2023)

Homeownership Rates in New York (Office of the New York State Comptroller, 2022)

Get a monthly dose of our latest insights!

About

myasianvoice

At MyAsianVoice, we connect Asian Americans to surveys and research to bridge the Asian data gap.

Join our growing respondent list >>