Money, Resources, Work

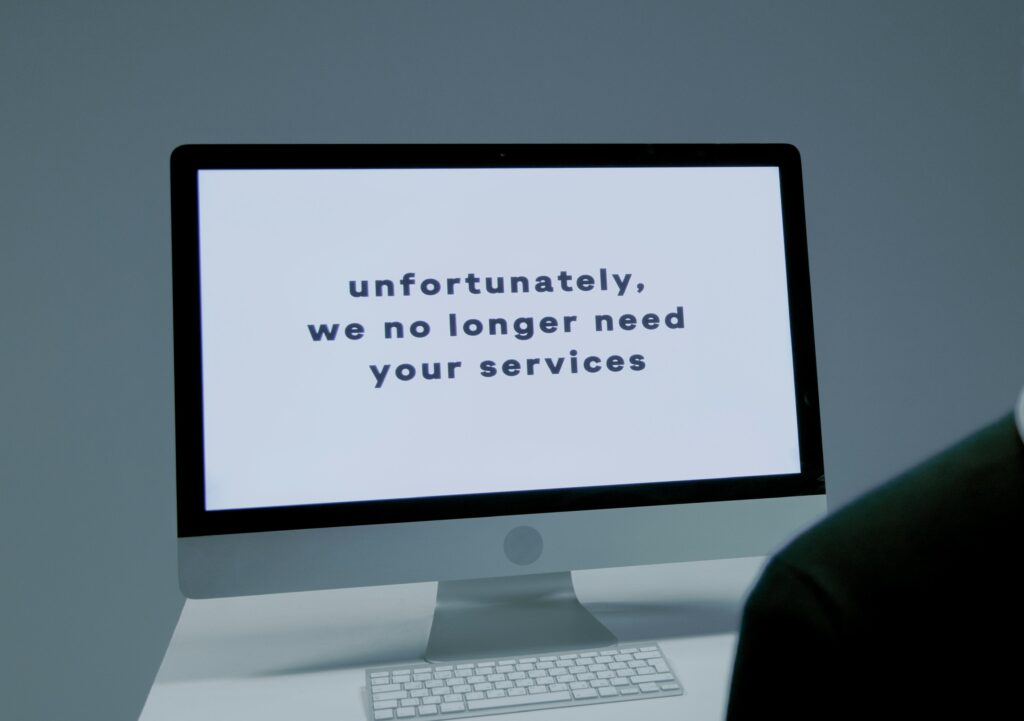

Foreign-born CEOs are fired more often and CEOs with favorable surnames are paid more

Recent studies found bias on corporate boards. Foreign-born CEOs, defined as CEOs born outside the country of the firms they lead, face a higher risk of dismissal by corporate boards, and CEOs with favorable surnames are paid more and fired less. CEO dismissals cost shareholders an estimated $112 billion annually. Increasing board diversity may help with board objectivity and effectiveness. In 2023, 75% of S&P 500 and 79% of Russell 3000 boards are White, and more than two-thirds are male.

Foreign-born CEOs are becoming more common in U.S. corporations, and CEO turnover is reaching new highs. Recent studies by separate researchers looked at CEO nativity and surname on dismissal likelihood and compensation. Their respective research found corporate boards are subject to bias. For foreign-born CEOs, defined as CEOs born outside the country of the firms they lead, they face higher risks of dismissal, and for CEOs with favorable surnames, they are paid more and fired less.

“Our findings suggest that employment bias…goes all the way up the chain into the highest echelons of management.”

Dr. Marketa Rickley of UNC Greensboro

Higher dismissal risk

Researchers, Marketa Rickley of UNC Greensboro and Yannick Thams of Florida Atlantic University, found disparities in the dismissal likelihoods between foreign-born and native-born CEOs when a company under-performs in their recently published study that analyzed 11,947 observations from U.S. firms in the Standard & Poor’s 500. Foreign-born CEOs face higher dismissal risk only when firm performance is low. Foreign-born CEOs are 4 times more likely to be fired than their native-born counterparts with a dismissal probability of 15.96% for foreign-born CEOs compared to 4.02% for native-born CEOs. Worth noting, female CEOs have been found to face a heightened risk of dismissal at all levels of firm performance.

Intergroup bias

The reasons for the higher dismissal risk have to do with how corporate boards attribute blame for a company’s under-performance. The board’s interpretations can be subject to intergroup bias, the positivity toward in-groups and negativity toward out-groups. Since it is up to the board to determine whether a firm’s performance is attributable to internal factors that CEOs can control or external factors that CEOs cannot control, foreign-born CEOs are disproportionately blamed for failures and discredited for successes.

A more favorable surname can equate to additional annual earnings of $240,699, above the average annual CEO salary of $5,482,910, and can also protect a person from job loss.

Name-induced perception and bias

Other researchers, Jay Heon Jung of City, University of London, Sonya Lim of DePaul University, and Jongwon Park of Hong Kong Polytechnic University, looked at CEO surnames and compensation. Their research analyzed data from thousands of CEOs in the S&P 1500 firms from 1999-2014 and found that CEOs with more favorable surnames were paid more and fired less. The researchers used country of origin associated with a surname and the weighted average of country favorability from Gallup poll data to assess surname favorability. The more favorable surnames were often associated with wealth and power. They estimated that a more favorable surname can equate to additional annual earnings of $240,699, above the average annual CEO salary of $5,482,910, and can also protect a person from job loss, even for under-performance. By comparison, CEOs with less favorable surnames were found to face greater scrutiny and pressure to perform.

A person’s name can influence other people’s perception of that person because it is often associated with attributes such as race, gender, age, and ethnicity.

The researchers also found non-founder or short-tenured CEOs were more susceptible to the surname favorability effects and that the effects were more pronounced for firms with lower institutional ownership. Their study provides new evidence on the effects of name-induced perception and bias. A person’s name can influence other people’s perception of that person because it is often associated with attributes such as race, gender, age, and ethnicity.

CEO dismissals cost shareholders an estimated $112 billion annually or a company average of $1.8 billion.

Board objectivity

These studies show the importance of objective CEO evaluations and corporate board diversity. CEO dismissals cost shareholders an estimated $112 billion annually or a company average of $1.8 billion per a PwC study of the world’s 2,500 largest companies. PwC also found that 32% of CEOs who depart in the first 5 years of their tenure were fired. In 2023, 75% of S&P 500 and 79% of Russell 3000 boards are White, and more than two-thirds are male. Increasing board diversity may help with board objectivity and effectiveness.

Helpful Resources

Are foreign-born CEOs held to a higher performance standard? The role of national origin in CEO dismissals (Global Strategy Journal)

Is your surname remunerative? Surname favorability and CEO compensation (Journal of Corporate Finance)

U.S. Public Company Board Diversity in 2023: How Corporate Director Diversity Can Contribute to Board Effectiveness (Harvard Law School Forum on Corporate Governance)

Today’s boardroom: confronting the change imperative (PwC’s 2023 Annual Corporate Directors Survey)

Get a monthly dose of our latest insights!

About

myasianvoice

At MyAsianVoice, we connect Asian Americans to surveys and research to bridge the Asian data gap.

Join our growing respondent list >>